Building a well-balanced relationship with your children gives you the chance to act as a parent and at times a coach. When you want to ensure the brightest and best future for your children as well as your own children, implementing a few tips to help teach financial responsibility along the way is key.

Establish A Positive View Of Financial Responsibility

Establishing a positive view and outlook of financial responsibility within the household is a great starting point to help get all children interested in finances and managing money.

Devise A Plan With Your Spouse

Create a working plan with your spouse when budgeting and sharing new tips, ideas and rules regarding financial planning, saving and spending for the kids. Talking with your spouse ensures you are on the same page before enforcing any new potential rules for your children to follow.

Talk Openly And Honestly About Finances

Talk openly and honestly about finances to your children when making financial decisions once they are old enough to work and begin saving money on their own. Even pre-teens can take on the occasional babysitting job if they demonstrate the necessary maturity. Learning is much easier for teenagers when they are following a positive and successful example in their own household.

Create Short And Long-Term Goals With Your children

Help get your children more involved and actively engaged with saving money and learning how to earn their own money by creating short and long-term goals. Creating goals and setting them in place with your children is a way to keep them focused and motivated to reach the end result.

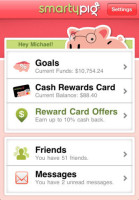

Provide Resources To Become More Financially-Savvy

When your child begins working or bringing in an income of their own it is important to point them in the right direction for the future. D Thode & Associates recommends visiting banks, downloading financial applications and giving tips on saving and earning from interest helps to guide your entire family to the path of success and financial freedom.

Communicate With Your Spouse When Enforcing Repercussions

Before handing out or enforcing punishments and repercussions in the home for poor financial decisions be sure to openly communicate with your spouse to make sure you are both on the same page. Another option is to simply not put any boundaries on how your children spend their money. While this may seem counterproductive on the surface, this technique actually reinforces wise financial decisions.

If your child is given an allowance of say $10 a week, they will have to learn to prioritize their spending. If they blow their allowance on the first day, then they will have to wait six more days until they receive their next $10. Waiting an entire six days to receive additional money will be enough motivation for most children to spend their money more wisely in the future.

Offer Allowances And Rewards For Positive Financial Decisions

Offering rewards and allowances is possible when your stepkids are able to demonstrate their ability to make the right financial decisions for themselves. Agreeing on a budget per child or for the amount of effort that was put into earning the allowance should also be discussed with your spouse before moving forward.

Understanding how to go about teaching your children financial responsibility without taking on the role of a dictator is essential to ensure the best potential future for your loved ones.